It’s a shrug, not a shudder.

That’s how most MSPs are reacting to the ongoing economic uncertainties in 2024, according to a recent MSP Success reader survey.

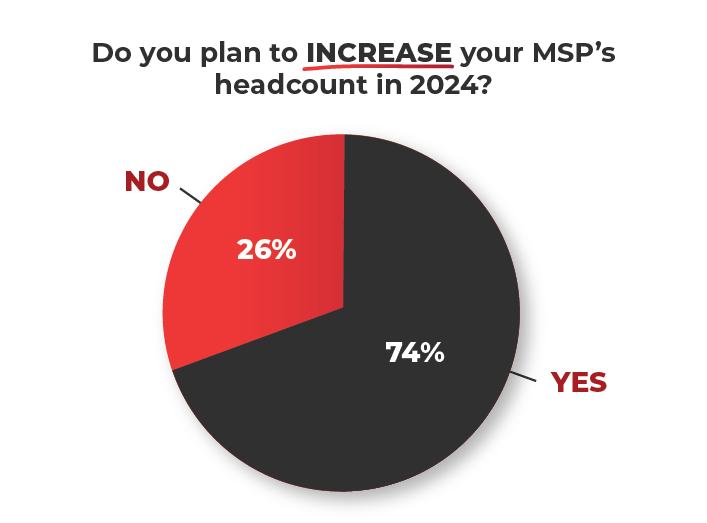

If not insulated from the impact of higher interest rates, lingering inflation, a still tight labor market, and an upcoming presidential election, MSPs learned during the pandemic that they can weather most storms. Plus, the industry itself has been riding the wave of several years of growth. A majority (74%) of MSPs surveyed, in fact, plan to increase their headcount this year.

That’s not to say there are no on-the-ground, day-to-day challenges that pose a threat to MSP businesses. Count cyberattacks, rising prices, competition, and hiring among the perils MSPs worry about. But overall, many are optimistic about 2024 and their ability to grow.

The Impact of Market Conditions

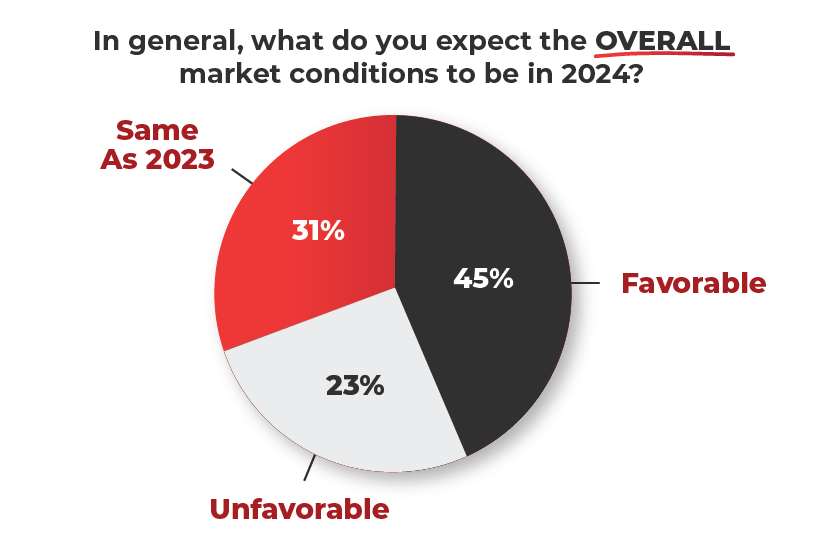

In general, expectations for the overall market conditions in 2024 are fairly evenly split: 45% of MSP Success survey respondents have favorable expectations, with 31% saying conditions will be about the same as 2023, and 24% say they expect overall market conditions to be unfavorable.

Matt Disher, president of Southwest Networks, an MSP in Palm Desert, California, expects the current economic uncertainty to impact customer spending in some areas, but not all. “I think people are going to remain cautious for 2024, but they seem to be opening up a little bit more to why security is needed,” he says. He notes that as more businesses look to get cyber insurance, they are becoming more aware of what security controls are required.

So, while spending on equipment upgrades and big projects may stall, Disher says, “on their services, I think they’re going to protect their businesses a little bit better.”

Charles Swihart, CEO of Preactive IT Solutions, is unphased by current market conditions. “You never know whose [what industry] is going to decline when, but typically, everything doesn’t decline at once.”

Timothy Guim’s perspective is similar to Swihart’s. “I think the economy is strong,” says the president and CEO of PCH Technologies, an MSP in Sewell, New Jersey. However, he notes, in Philadelphia, his real estate clients are struggling. But his construction, manufacturing, and financial customers are doing well. “I think I’m pretty bullish overall on the market right now.”

Choosing the right clients is key to weathering economic turbulence, according to Dan Napolitano, founder and CEO of The Garam Group, an MSP in Syracuse, New York. “We’re very selective about the clients that we take on,” he explains. They categorize clients as A,B,C, and D level, and only take A’s and B’s. “We’ll take a C occasionally, but only if we feel like we can grow them to a B,” Napolitano says.

A- and B-level clients “have good management. They have good vision. And those clients don’t seem to be as affected by what’s going on in the world. … In general, when times are tough, we haven’t seen problems in our client base.”

Where Growth Will Come From

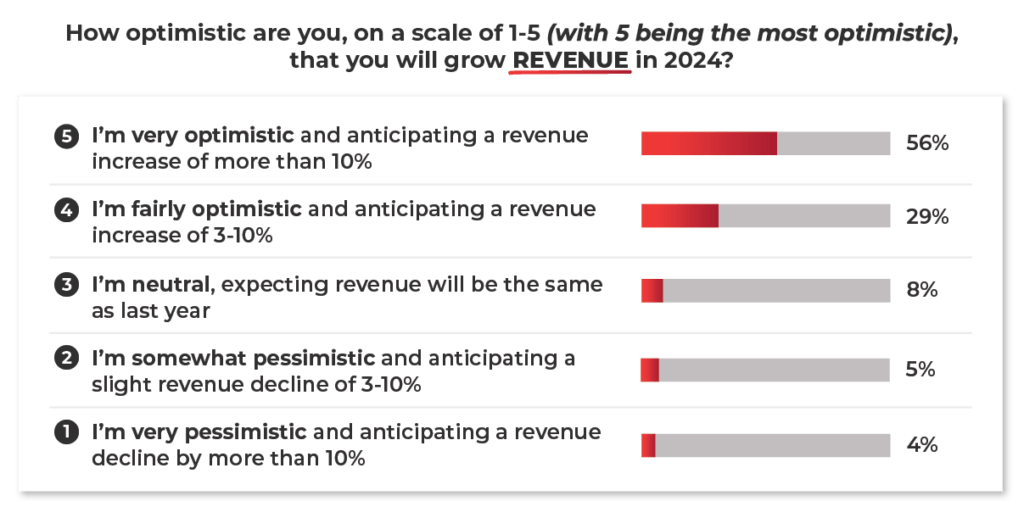

Slightly more than half of MSP Success survey respondents (56%) are very optimistic that they will increase revenue more than 10% this year, while 29% say they’re fairly optimistic about growth and expect a revenue increase of 3-10%. Meanwhile, just 8% expect revenue to be level with 2023, 5% expect a small decline of 3-10%, and just 4% anticipate a revenue drop of more than 10%.

Swihart has been driving growth by investing in sales, SEO optimization of their website, an EOS coach, and in-person marketing activities such as participating in construction industry events.

“Last year we did $3 million in revenue,” says Swihart. “My current run rate is already predicting that I will be at least $3.5 million this year, which is nearly 20% growth. So, I would say I’m extremely optimistic.” He adds that last year Preactive added six new clients and has already matched that in the first quarter of this year.

For Disher’s part, he expects to grow revenue by less than 10% and is tackling that challenge by looking to expand geographically. In addition, “I’m concentrating on the TBR’s and getting my clients to adopt the newer security offerings that we have as well as possibly move up in our service contract offering itself,” he says.

For Guim, cybersecurity, including compliance and risk assessments, will be the biggest growth driver. He is expecting revenue growth of at least 10%. “That’s where we’re focusing our effort because we feel that traditional IT managed services—help desk and on-site support—that’s going to go away in the future.” He expects cybersecurity, AI, and automation to be where the industry is going.

He is making plans to roll out an AI-as-a-service offering and looking to get a skilled resource in place. For example, he says, with a construction customer, they would build an AI engine that could use the raw data of drawings, contracts, and other information to complete tasks faster and securely.

“The AI adoption is going to be faster than the things we see in the past, so that’s why I’m trying to move as quickly as possible to embrace the change and hopefully be successful with it,” he says.

How MSPs Are Driving Profits

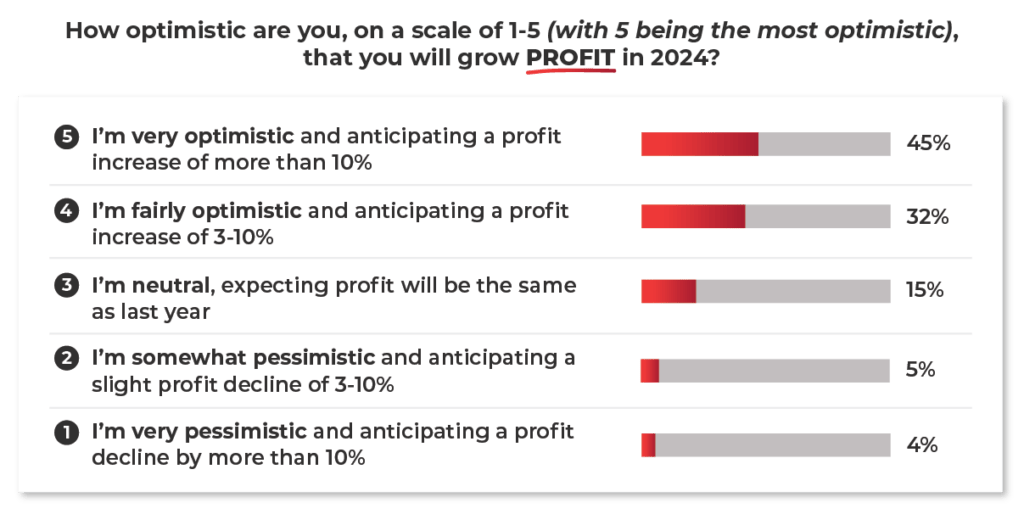

The outlook on profits is only slightly less optimistic than revenue expectations, with 45% of MSP Success survey respondents very optimistic that they can increase profits by 10% or more, while 32% anticipate a profit increase of 3-10%. About 15% expect profits to be the same as last year. Only 5% call themselves “somewhat pessimistic,” expecting a small decline of 3-10%, and just 4% project a profit decline of more than 10%.

While Napolitano says his company has grown revenue a slow but reliable 1-5% every year over its 24-year history, his focus is on driving profit this year by raising his prices. “Already in the first quarter, our profitability is over 10%. …. I’m pretty optimistic that’s going to continue.”

He adds, “It used to be, I want my customers to love me, and I want to take awesome care of them. And those two things still matter paramount, but it’s not a charity. I also need them to be in the right profitability bracket. Whoever’s not in that bracket, they don’t need to be our clients.”

Disher has also raised prices for new customers, as well as rewritten contracts with automatic price increases upon renewal for existing customers. He has worked to improve the company operations too, “so internally we’re able to do more with less in some instances. It’s helped us increase profit margins.” Profits for Southwest Networks, which is an ESOP, “are typically above 10%,” he notes.

Driving profit is a main focus for PCH technologies this year, Guim says. In addition to being very selective about new clients, he’s also focusing on operations. “We’re looking at how we can improve our operational efficiencies. This year we’re implementing RPA [robot process automation] solutions.”

In addition, he says, “We’re building an AI and Automation division as part of our projects team, in order to see how we can be more efficient in everything that we do, to offset our cost of increased wages for our talent at PCH.”

He views the new division as a capital expense. “We’re going to have to invest in a full-time resource to get the most value out of our automation and AI. But if you look two to three years out, [we’re] going to have tremendous cost savings by being able to scale with automation.”

Threats And Challenges In 2024

Competition, ranging from “Super MSPs” that have deep pockets and resources all the way down to one-person “fly by night” business that hang an MSP shingle, is one of the threats MSP Success survey respondents point to for 2024. Other threats include cybersecurity, hiring, rising prices, the economy, a slowdown in customer spending, and keeping up with new technology.

In his market, Swihart has gone up against an MSP that’s 10 times his size who under bids him. Whereas Swihart seeks to be more of a boutique offering with a personal touch for fewer customers and make 30% margin, that larger MSP may be “making 8% profit on a much larger number of customers, and they’re not going to be quite be as happy,” he explains.

Swihart likens that larger MSP to Walmart. “Competing with that can be tough, especially if the economy turns down,” he notes. “If I were going to worry about something, it would be that.”

Disher has seen competition on the other end of that spectrum. “Some of the smaller companies that do IT work are reducing their pricing and we’ve also seen an increase of more one-man bands out here,” he says. “[They have] no overhead, no tools, no nothing, and offer ‘supposed IT services’ at a cheaper rate.”

Clients, he says, don’t always understand what true managed service means, and since there’s no standardization in the industry, he works to educate clients and establish authority.

Standardization or regulation could be a double-edge sword, says Swihart. “I could see state governments coming in and wanting to put specific regulations on IT companies,” he notes. “Any savvy business owner would tell you what you’ve got to do is figure out how that threat becomes an advantage to you.” That might include becoming SOC 2 compliant as a competitive differentiator, he says, which is on his radar but not something he’s actively pursuing at the moment.

Cybersecurity is what Guim identifies as the biggest threat to his company, specifically a supply chain attack that uses an MSP as a vector to infiltrate their clients, like the recent ConnectWise ScreenConnect security vulnerabilities that have been exploited by hackers. “It’s happened to other MSPs already,” he says.

Guim is doing everything he can to shore up his business against a supply chain attack but sees that as the number one threat to his customers, his team, and his business. “That’s the one nuclear option that I would never want to wish on anybody.”

Another business threat that survey respondents point to is the challenge of hiring and retaining quality workers. This is what Napolitano struggles with, particularly with his five-person help desk of Tier 1, entry-level techs. “Somebody’s always out sick every week, every day. I always have four people there instead of five.”

To improve how they recruit and hire, Napolitano says his leadership team is shifting how it assesses people. “We are looking for character and work ethic. We always look for those, but it was more of a hunch. Now we have questions geared towards lending some light to those areas of people’s characteristics.”

They are also moving away from soft skills and are now seeking to hire people with a four-year degree or a two-year degree with certifications. “I feel like if you’ve got what it takes to make it through a four-year degree, then you have some of the determination and dedication we’re looking for.”

MSPs Will Continue To Be Needed

There’s no shortage of determination, dedication, and grit among MSP business owners, and it appears that will continue to pay off despite any ups and downs in the economy. After all, there’s no shortage of need for tech expertise.

Notes Jay McBain, chief analyst at Canalys, “Every company in every industry is becoming a technology company. Every pharmaceutical company, every automotive company, bank, insurance company—everyone is becoming a tech company. And who is better suited to help them get there than technology companies themselves?”